How to Freeze Or Unfreeze Your Credit File for Free

Freezing or unfreezing your credit file is easier than you think. It’s also free and can protect you from identity theft.

Managing your credit file is crucial in today’s world. Freezing your credit can prevent unauthorized access, adding an extra layer of security. Unfreezing is just as simple, allowing you to regain control when needed. This process can be essential for anyone concerned about their financial security.

Many people don’t realize that they can do this at no cost. In this guide, you’ll learn step-by-step how to freeze or unfreeze your credit file. Protect your financial health with these simple actions.

Benefits Of Freezing Credit

Freezing your credit file can be a wise decision. It blocks access to your credit report, adding a layer of security. Here are some key benefits of freezing your credit.

Protection Against Identity Theft

Freezing your credit protects against identity theft. Thieves can’t open new accounts in your name. They can’t get loans or credit cards without your permission. This makes it harder for them to misuse your information. Identity theft can ruin your financial life. Freezing your credit helps you avoid this pain. It’s a simple step that adds strong protection.

Control Over Personal Information

Freezing your credit gives you control over your personal information. You decide who can access your credit report. Only the people you authorize can see it. This limits exposure to potential fraudsters. You can unfreeze your credit anytime. This flexibility ensures you stay in charge. With a credit freeze, you control your financial safety.

Steps To Freeze Your Credit

Freezing your credit file can protect you from identity theft. It prevents unauthorized access to your credit report. Follow these simple steps to freeze your credit.

Gather Necessary Information

Before freezing your credit, gather the needed information. You will need:

- Your full name

- Address

- Date of birth

- Social Security number

- Government-issued ID

- Proof of residence

Having these ready makes the process easier. Ensure the documents are up-to-date. This helps avoid any delays.

Contact Credit Bureaus

You must contact each of the three major credit bureaus. They are:

- Equifax

- Experian

- TransUnion

Each bureau has its own process. Contact them via phone, mail, or their website. Here is the contact information:

| Credit Bureau | Website | Phone Number | Mailing Address |

|---|---|---|---|

| Equifax | www.equifax.com | 1-800-349-9960 | P.O. Box 105788, Atlanta, GA 30348 |

| Experian | www.experian.com | 1-888-397-3742 | P.O. Box 9554, Allen, TX 75013 |

| TransUnion | www.transunion.com | 1-888-909-8872 | P.O. Box 2000, Chester, PA 19016 |

Submit your request to each bureau. They will confirm your identity. Once verified, they will freeze your credit file. This usually takes a few days.

Freezing Credit With Equifax

Freezing your credit with Equifax is a smart way to protect yourself from identity theft. This process prevents new creditors from accessing your credit file. It ensures no new accounts can be opened in your name without your knowledge. Equifax offers a simple and free way to freeze your credit. You can do it online or by phone.

Online Process

To freeze your credit online, visit the Equifax website. Create an account if you don’t have one. Log in to your account and navigate to the security freeze section. Follow the prompts to place a freeze on your credit. You will need to provide personal information. This includes your name, address, and Social Security number. After submission, you will receive a confirmation email. This confirms your freeze is in place.

Phone Process

If you prefer, you can freeze your credit by phone. Call Equifax at their toll-free number: 1-800-685-1111. Follow the automated prompts to request a security freeze. Be ready to provide your personal information. This includes your name, address, and Social Security number. You may also need to answer security questions. Once completed, you will get a confirmation number. Keep this number for your records.

Freezing Credit With Experian

Freezing your credit with Experian is a smart way to protect yourself from identity theft. It stops anyone from opening new accounts in your name. And it’s free. Let’s explore how to freeze your credit with Experian using both online and mail processes.

Online Process

Freezing your credit online with Experian is quick and easy.

- Visit the Experian Freeze Center.

- Click on “Add a security freeze.”

- Create an account or log in to your existing one.

- Provide your personal information: name, address, Social Security number, and date of birth.

- Answer some security questions to verify your identity.

- Set a PIN or password that you will use to lift the freeze.

- Submit your request and receive confirmation.

Remember to keep your PIN or password safe. You’ll need it to unfreeze your credit later.

Mail Process

Prefer handling things offline? You can freeze your credit by mail.

- Write a request letter to Experian. Include your full name, address, Social Security number, and date of birth.

- Provide copies of documents to verify your identity. Typically, this includes a government-issued ID and a utility bill or bank statement.

- Specify that you want a security freeze placed on your credit file.

- Mail your request to the following address:

Experian Security Freeze P.O. Box 9554 Allen, TX 75013

Experian will process your request and send you a confirmation letter. This will include your PIN or password for lifting the freeze.

Freezing Credit With Transunion

Freezing your credit file with TransUnion is a smart move to protect your financial health. It blocks access to your credit report, stopping new credit applications in your name. Freezing your credit is free and easy to do.

Online Process

Visit the TransUnion website and create an account if you don’t have one. Log in to your account. Navigate to the section for credit freezes. Follow the prompts to freeze your credit file. You will need to provide some personal details. These include your name, address, and Social Security number. TransUnion will confirm your identity with security questions. After completing these steps, your credit file will be frozen. You will receive a confirmation email.

Phone Process

Call TransUnion at their toll-free number. Make sure to have your personal information ready. This includes your name, address, and Social Security number. An automated system will guide you through the process. Follow the prompts to freeze your credit. You may need to answer some security questions. Once done, your credit file will be frozen. TransUnion will send you a confirmation by mail or email.

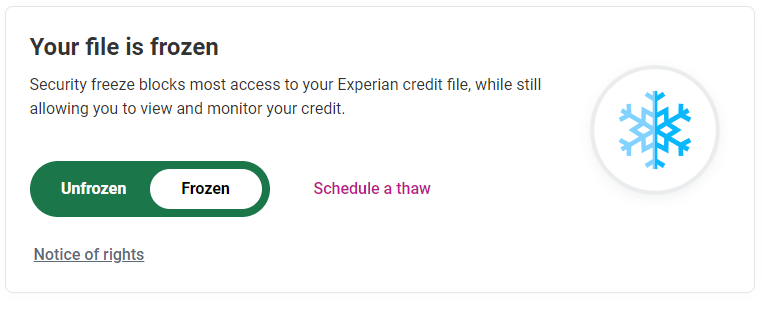

Unfreezing Your Credit

Unfreezing your credit is an important step when you need access to credit. This process allows creditors to check your credit file. Learn how to do it for free.

Temporary Lift

Sometimes you need to unfreeze your credit for a short period. A temporary lift allows you to do this. You can choose how long the lift lasts. It can be a few days or weeks. This option is useful if you are applying for a loan or credit card. After the set period, your credit file will freeze again.

Permanent Lift

A permanent lift removes the freeze completely. This is useful if you no longer need the security of a freeze. To do this, contact the credit bureaus. Provide your PIN or password. Your credit file will then be accessible to creditors. This process can be done online or by mail.

Tips And Considerations

Freezing or unfreezing your credit file can be essential for protecting your financial health. Understanding the tips and considerations for this process will help you manage your credit effectively. Here are some key points to keep in mind.

Storing Your Pin Safely

When you freeze your credit, you will receive a PIN. This PIN is necessary to unfreeze your file later. Keep this PIN secure to avoid potential issues. Here are some tips for storing your PIN safely:

- Write it down and store it in a safe place.

- Avoid sharing it with others.

- Consider using a password manager.

Never share your PIN through email or text. These methods are not secure.

Monitoring Your Credit

Even with a frozen credit file, you should still monitor your credit. This ensures that no unauthorized activities occur. Here are some ways to monitor your credit:

- Check your credit report annually from each major bureau.

- Sign up for free credit monitoring services.

- Review your bank and credit card statements regularly.

Catch any discrepancies early to prevent identity theft. By following these tips and considerations, you can manage your credit file more effectively and keep your financial information secure.

Frequently Asked Questions

What Is A Credit File Freeze?

A credit file freeze restricts access to your credit report. This prevents identity thieves from opening new accounts in your name.

How Do I Freeze My Credit File?

You can freeze your credit file by contacting major credit bureaus. This can be done online, by phone, or by mail.

Is Freezing Your Credit Free?

Yes, freezing your credit is free. All three major credit bureaus offer this service without any charge.

How Do I Unfreeze My Credit File?

To unfreeze your credit file, contact the credit bureaus. You can do this online, by phone, or by mail.

Conclusion

Freezing or unfreezing your credit file is easy and important. It protects against identity theft. You can do it for free. Follow the steps mentioned. Keep your personal information safe. Always stay aware of your credit status. Regularly check your credit report.

This ensures no suspicious activity goes unnoticed. Managing your credit file wisely safeguards your financial future. Take control today.