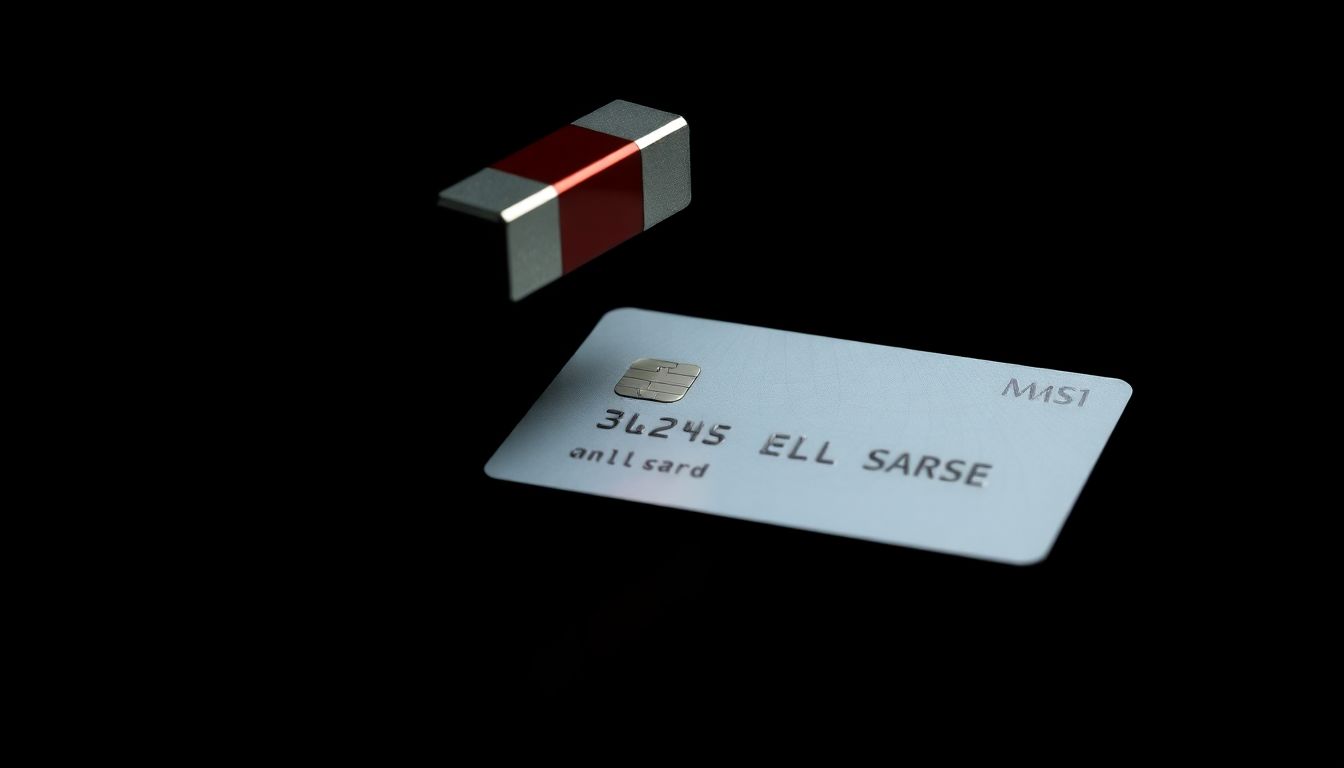

Will a Magnet Ruin Your Credit Card?

In our increasingly digital world, credit cards have become an essential part of our daily lives. They offer convenience, security, and the ability to make purchases without carrying cash. However, many people wonder about the potential risks associated with credit cards, particularly when it comes to magnets. Can a magnet ruin your credit card? In this blog post, we will explore the relationship between magnets and credit cards, the science behind how they work, and what you can do to protect your cards.

Understanding Credit Cards

Before diving into the effects of magnets on credit cards, it’s essential to understand how these cards function. Most credit cards have two primary components: a magnetic stripe and a chip.

The Magnetic Stripe

The magnetic stripe, often referred to as the magstripe, is a black strip on the back of the card. It contains three tracks of data, which store important information such as:

- Account Number: Your unique credit card number.

- Cardholder Name: The name of the person to whom the card is issued.

- Expiration Date: The date until which the card is valid.

The data on the magnetic stripe is encoded using tiny iron-based particles that can be magnetized. When you swipe your card at a point-of-sale terminal, the reader detects the magnetic field and retrieves the stored information.

The Chip

In addition to the magnetic stripe, most modern credit cards also feature an embedded chip. This chip uses a different technology called EMV (Europay, MasterCard, and Visa) to process transactions. EMV chips generate a unique transaction code for each purchase, making them more secure than magnetic stripes.

Can a Magnet Ruin Your Credit Card?

Now that we understand how credit cards work, let’s address the main question: can a magnet ruin your credit card? The short answer is yes, but the extent of the damage depends on several factors.

The Impact of Magnets on Magnetic Stripes

-

Demagnetization: The primary risk associated with magnets and credit cards is demagnetization. When a strong magnet comes into contact with the magnetic stripe, it can disrupt the alignment of the iron-based particles, erasing the encoded data. This can render the card unusable, as the point-of-sale terminal will not be able to read the information.

-

Strength of the Magnet: Not all magnets are created equal. While everyday items like refrigerator magnets are relatively weak, they can still cause damage if the card is in close contact for an extended period. Stronger magnets, such as those found in certain electronic devices or industrial applications, pose a greater risk of demagnetization.

-

Duration of Exposure: The length of time your credit card is exposed to a magnet also plays a crucial role. A brief encounter with a weak magnet may not cause any noticeable damage, while prolonged exposure can lead to data loss.

The Role of EMV Chips

Fortunately, many modern credit cards come equipped with EMV chips, which are not affected by magnets. If your card has a chip, it is less likely to be ruined by a magnet, even if the magnetic stripe becomes demagnetized. However, it’s still essential to protect your card to ensure it functions correctly.

Common Sources of Magnet Exposure

Understanding where you might encounter magnets in your daily life can help you take precautions to protect your credit cards. Here are some common sources of magnet exposure:

-

Refrigerator Magnets: These are perhaps the most common magnets people encounter. If you store your credit card on the fridge or near a strong magnet, it could become demagnetized.

-

Wallets with Magnetic Closures: Some wallets and purses feature magnetic closures for convenience. If your credit card is placed too close to the magnet, it may be at risk.

-

Security Tag Deactivators: Retail stores often use strong magnets to deactivate security tags on merchandise. If you accidentally place your card near one of these devices, it could become demagnetized.

-

Electromagnetic Fields: Devices like mobile phones, tablets, and laptops emit electromagnetic fields that can interfere with the magnetic strip on your credit card. While the risk is relatively low, it’s still a good idea to keep your cards away from these devices.

-

MRI Machines: If you ever need to undergo an MRI, be sure to leave your credit cards outside the scanning room. The strong magnetic fields generated by MRI machines can easily demagnetize your cards.

What to Do If Your Card Becomes Demagnetized

If you suspect that your credit card has been demagnetized, there are a few steps you can take:

-

Try Swiping the Card: First, attempt to use the card at a point-of-sale terminal. If it doesn’t work, you may need to take further action.

-

Manual Entry: If the card is demagnetized, cashiers can often manually enter your card details to process the transaction. This can be a temporary solution while you seek a replacement.

-

Contact Your Bank: If your card is no longer functioning, reach out to your bank or credit card issuer. They can verify the issue and issue a replacement card if necessary. Most banks have a straightforward process for replacing damaged cards.

-

Monitor Your Account: Keep an eye on your account for any unauthorized transactions, especially if your card was demagnetized due to exposure to a potentially risky environment.

Preventing Credit Card Demagnetization

Taking proactive steps can help you avoid the hassle of dealing with a demagnetized credit card. Here are some tips to protect your cards:

-

Store Cards Properly: Keep your credit cards in a designated slot in your wallet or purse, away from magnets. Avoid placing them near items like fridge magnets or magnetic closures.

-

Use RFID-Blocking Wallets: Consider investing in RFID-blocking wallets or sleeves. These products are designed to protect your cards from electromagnetic interference and unauthorized scanning.

-

Be Cautious with Electronics: When using electronic devices, be mindful of where you place your credit cards. Avoid keeping them in the same pocket or compartment as your phone or tablet.

-

Educate Yourself: Understanding the risks associated with magnets and credit cards can help you make informed decisions about how to handle your cards in various situations.

-

Avoid Strong Magnetic Fields: If you know you’ll be in an environment with strong magnetic fields, such as near MRI machines or industrial equipment, leave your credit cards in a safe place.

Conclusion

In conclusion, while magnets can potentially ruin your credit card by demagnetizing the magnetic stripe, the risk is manageable with proper precautions. Understanding how credit cards work, recognizing common sources of magnet exposure, and taking steps to protect your cards can help you avoid the inconvenience of a demagnetized card. By being proactive and informed, you can continue to enjoy the convenience of credit cards without worrying about the impact of magnets.