Why Is Personal Finance Dependent Upon Your Behavior?

Personal finance is not just about crunching numbers; it’s deeply tied to your behavior. Your choices, habits, and mindset shape how you earn, spend, and save money. This post will explore how personal finance is dependent upon your behavior and what you can do to improve it. Understanding this link will empower you to make better financial decisions and reach your goals and share how your Personal Finance Dependent Upon Your Behavior

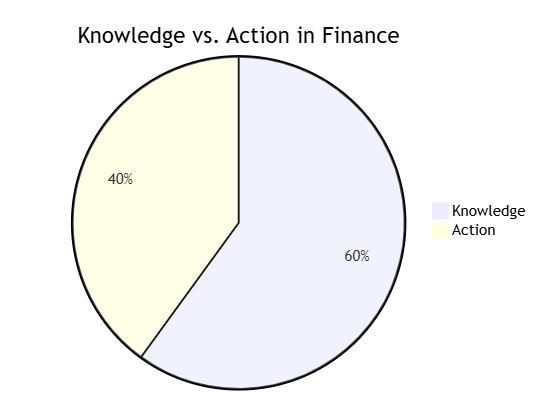

Behavior vs. Knowledge in Finance

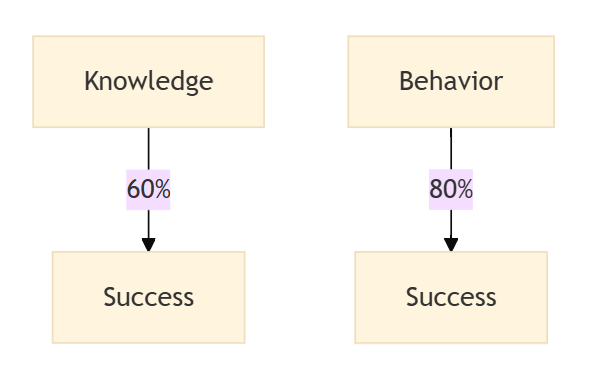

You might think that financial success is all about knowing the right things—like how to invest or budget. But, in reality, it’s often more about what you do with that knowledge. Many people understand the basics of finance, yet struggle because their behavior doesn’t align with what they know. It’s like knowing you should eat healthy but always reaching for the junk food. Behavioral finance explores how our actions, often irrational, impact our financial decisions. Behavioral finance examines the impact of psychology on financial decision-making, highlighting the irrational behaviors that often influence our financial choices.

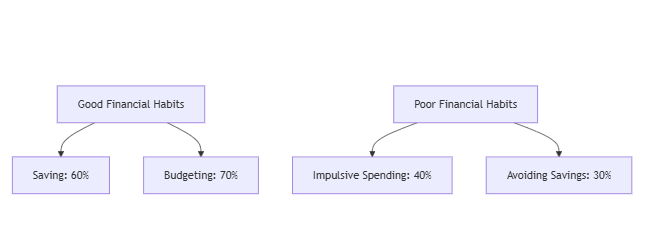

The Impact of Daily Habits

Our daily habits—those small, seemingly insignificant choices—add up over time and can lead to either financial stability or stress. Whether it’s grabbing a coffee every morning or setting aside a bit of money each week, these habits define our financial health. Over time, consistently good habits can lead to wealth accumulation, while poor ones can result in debt and financial anxiety.

Changing your financial behavior isn’t always easy, but it’s crucial for long-term success. By recognizing and adapting your habits, you can create a more secure financial future. It’s not just about what you know; it’s about what you do every day.

How Upbringing Shapes Financial Behavior

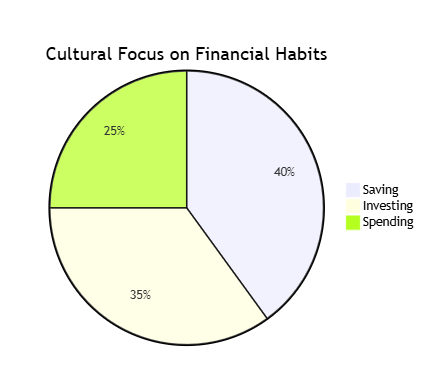

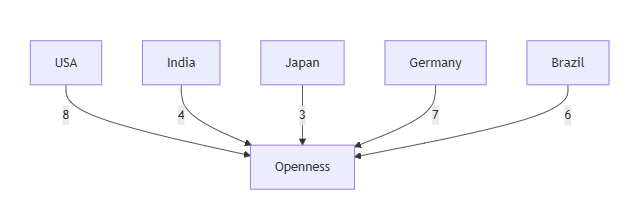

Cultural Influences on Spending

Ever notice how your spending habits might mirror those of your parents or even your grandparents? That’s the cultural influence at play. Different cultures have unique perspectives on money, shaping how we view and handle finances. For instance, in some cultures, discussing money openly is frowned upon, leading to a lack of financial literacy and awareness. In others, there’s a strong emphasis on saving and investing, instilling a sense of financial prudence from a young age.

Family Attitudes Towards Money

The way families talk—or don’t talk—about money can leave a lasting impact. If you grew up in a household where money was always a source of stress, you might associate financial management with anxiety. Conversely, a family that openly discusses budgets and savings can foster a more relaxed and informed approach to finances. Family financial socialization is key; it influences how we perceive money and make financial decisions as adults.

Early Financial Education

Learning about money doesn’t just happen in school; it starts at home. Parents who engage their kids in conversations about saving, budgeting, and spending impart crucial life skills. This early financial education sets the groundwork for how kids will handle money in the future. Whether it’s through an allowance or discussions about household finances, these lessons shape financial behavior significantly.

The habits we pick up from our families can guide or misguide us in our financial journeys. Understanding these influences helps us make conscious choices about our financial futures.

The Psychology Behind Financial Decisions

Emotional Impact on Spending

Emotions play a huge role in how we handle money. Ever had that rush when you find a great deal or the stress when bills pile up? That’s your emotions steering your financial ship. Emotions can drive impulsive spending, sometimes leading to regret. It’s like retail therapy – feels good in the moment, but not always great for the bank account. Understanding these emotional triggers can help you make more thoughtful choices.

Cognitive Biases in Finance

We all have these mental shortcuts, or biases, that can mess with our money decisions. For instance, confirmation bias makes us seek info that backs up what we already think, ignoring better options. Then there’s loss aversion – hating to lose so much that it clouds our judgment. Recognizing these biases is key to making smarter financial moves.

Behavioral Economics Explained

Behavioral economics is this neat field that mixes psychology with finance. It looks at why people make the money choices they do, even when they’re not logical. Traditional economics assumes we’re all rational, but behavioral economics knows we’re not. It’s about understanding the emotional and social factors that influence our financial decisions.

Financial decisions are not purely rational; they are significantly shaped by emotions, beliefs, and psychological factors. Understanding the emotional side of finances is crucial for making informed decisions. Understanding the emotional side of finances is crucial for making informed decisions.

Strategies to Improve Financial Behavior

Setting Clear Financial Goals

Setting clear financial goals is like drawing a map to financial freedom. These goals should be specific and achievable, giving you a target to aim for. Without them, it’s easy to drift and lose motivation. Think about what matters most to you financially. Maybe it’s paying off that pesky debt, saving for a dream vacation, or beefing up your retirement fund. Whatever it is, make sure your goals are realistic and fit within a timeframe you can manage.

Creating and Sticking to a Budget

Once your goals are set, the next step is creating a budget. A budget isn’t just a list of numbers; it’s a plan for your money. It helps you see where your cash is going and identify any leaks. Start by listing your income and expenses. Then, see where you can cut back to save more. Sticking to your budget is crucial—it keeps you on track with your goals. Use tools like apps or online banking to help monitor your spending. Remember, even small purchases add up over time.

Seeking Professional Financial Advice

Sometimes, you need a little help to get your finances in order. That’s where professional financial advice comes in. A financial advisor can offer insights and strategies tailored to your situation. They can help you make informed decisions about investing, saving, and spending. Don’t be shy about reaching out for help—it’s a smart move if you’re serious about improving your financial behavior.

Improving your financial behavior is a journey. It requires patience, discipline, and sometimes a bit of outside help. But with the right strategies in place, you can achieve financial wellness and peace of mind.

These strategies are just a starting point. Establishing financial wellness involves key steps such as creating a budget, managing cash flow and debt, building an emergency fund, and implementing smart money habits. With dedication, you can turn these practices into habits that support a healthier financial future.

The Connection Between Behavior and Money Management

Impulsive Spending Habits

Impulsive spending can really mess with your finances. Picture this: you’re out shopping, and suddenly that new gadget or trendy outfit seems irresistible. It’s like your brain flips a switch, and before you know it, you’re swiping your card. This is impulsive spending, and it’s a behavior that can sabotage your financial goals.

- Recognizing Triggers: Start by identifying what sets off your impulsive buying. Is it stress? Boredom? Once you know, you can find ways to manage these triggers.

- Setting Limits: Create a budget that includes a specific amount for “fun money.” This way, you can indulge occasionally without going overboard.

- Mindful Shopping: Before making a purchase, pause and ask yourself if it’s a want or a need. This simple question can save you from many regrettable buys.

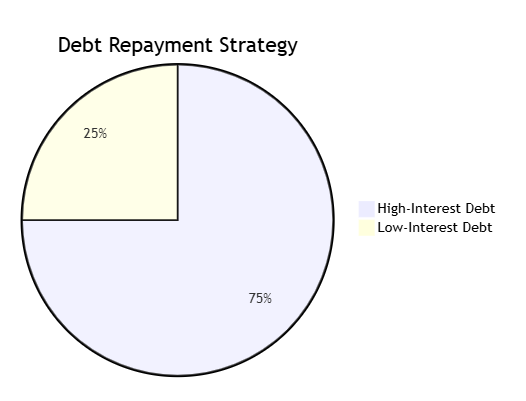

Debt Accumulation and Management

Debt is tricky. It’s easy to get into but hard to get out of. The way you handle debt can shape your financial future, for better or worse. Many people fall into the trap of accumulating debt due to easy access to credit. But managing debt requires a strategic approach.

- Understand Your Debt: Know exactly how much you owe and to whom. This awareness is the first step in taking control.

- Prioritize Payments: Focus on paying off high-interest debts first. This will save you money in the long run.

- Consider Consolidation: If you have multiple debts, consolidating them might make it easier to manage payments and reduce interest rates.

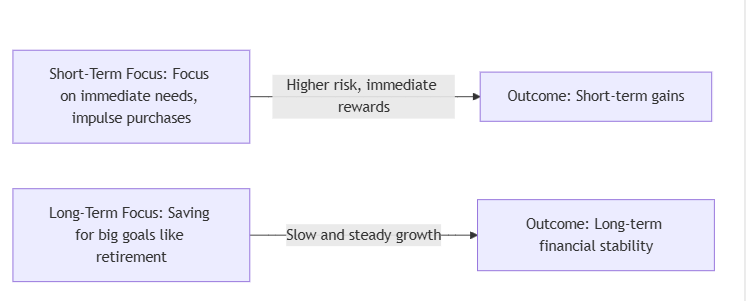

Long-Term vs. Short-Term Financial Planning

Balancing short-term desires and long-term goals is key to sound money management. It’s tempting to focus on immediate pleasures, but this can derail your plans for the future.

- Set Clear Goals: Define what you want to achieve financially in the next 5, 10, or 20 years. This could be buying a house, retiring comfortably, or traveling.

- Create a Timeline: Break down your goals into manageable steps with specific timelines. This makes them less daunting and more achievable.

- Regularly Review Plans: Life changes, and so should your financial plans. Revisit and adjust them as needed to stay on track.

Financial behavior isn’t just about the numbers; it’s about the choices we make daily. By understanding the connection between our behavior and money management, we can pave the way for a more secure financial future. It’s about being proactive, making informed decisions, and sometimes, just pausing before you spend.

The Importance of Financial Discipline

Financial discipline isn’t just about saving money; it’s a way of life that requires consistent effort and attention. It’s about making smart choices that lead to financial stability and peace of mind. Let’s explore some key aspects of financial discipline.

Building a Savings Plan

Creating a savings plan is like building a safety net for your future. Having a savings plan means you’re prepared for unexpected expenses and can avoid the stress of financial emergencies. Start by setting aside a small percentage of your income and gradually increase it as you become more comfortable. The key is to make saving a regular habit, much like brushing your teeth or exercising. Over time, this discipline can lead to significant financial growth.

Avoiding Unnecessary Debt

Debt can be a slippery slope, and avoiding unnecessary debt is crucial for maintaining financial health. It’s important to differentiate between good and bad debt. Good debt, like a mortgage or student loans, can lead to future financial benefits, while bad debt, such as credit card debt, can quickly spiral out of control. Make it a habit to pay off your credit card balance in full each month and think twice before taking on new debt. Consider automating your paycheck routine to help minimize the effort required to manage finances effectively.

Practicing Mindful Spending

Mindful spending is all about being aware of where your money goes. It’s easy to fall into the trap of impulse buying, especially with online shopping being so convenient. Practicing mindful spending involves taking a step back and asking yourself if a purchase is necessary. You might even want to implement the 48-hour rule: wait 48 hours before making a purchase decision. This simple practice can help you avoid unnecessary expenses and keep your budget on track.

Financial discipline is the backbone of a stable and prosperous financial life. By focusing on building a savings plan, avoiding unnecessary debt, and practicing mindful spending, you set yourself up for success. Remember, the journey to financial discipline is a marathon, not a sprint. Small, consistent steps can lead to big changes over time.

Behavioral Economics and Personal Finance

Behavioral economics is a fascinating field that blends psychology with traditional economic theory to better understand how we make financial decisions. Unlike the classic economic view, which assumes people always act rationally, behavioral economics recognizes that we’re often swayed by emotions and cognitive biases. These insights help financial institutions understand client behavior and decision-making processes.

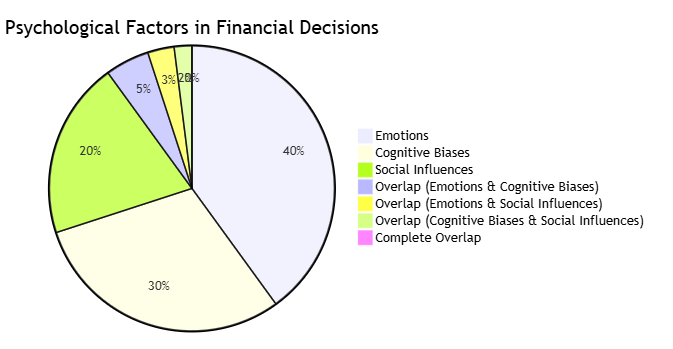

Psychological Factors in Financial Decisions

Our financial choices are often influenced by psychological factors, such as emotions, cognitive biases, and social influences. For example, fear or excitement can lead to impulsive spending, while biases like confirmation bias might make us ignore information that contradicts our beliefs. Social pressures, like the urge to “keep up with the Joneses,” can also drive us to make financial decisions that aren’t in our best interest. Recognizing these factors can help us make more informed choices.

Impact of Social Norms on Finance

Social norms play a significant role in shaping our financial behavior. These are the unwritten rules that dictate how we think we should behave financially. For instance, the pressure to spend lavishly on weddings or holidays can lead to financial strain. By understanding and questioning these norms, we can make financial decisions that align better with our personal goals and values.

Behavioral economics provides valuable insights into why we often make irrational financial decisions. By acknowledging the psychological and social factors at play, we can work towards making more rational and beneficial financial choices.

The Influence of Cognitive Biases on Financial Choices

Understanding Common Biases

Cognitive biases are like those sneaky shortcuts our brains take, and they can seriously mess with our financial decisions. Confirmation bias, for instance, makes us hunt for info that backs up what we already believe, ignoring all the other stuff. Then there’s loss aversion, where we freak out more about losing money than getting it, even if the odds are in our favor. And don’t forget about anchoring bias, which has us stuck on some random number when making choices. Knowing these biases helps us dodge their traps and make better money moves.

Overcoming Loss Aversion

Loss aversion is a biggie. It’s why people might hold onto a losing stock, hoping it’ll bounce back, instead of cutting their losses. To get past this, try focusing on the bigger picture. Make a list of your long-term goals and see how these decisions fit in. Remind yourself that sometimes taking a small hit now can mean bigger gains later. It’s all about shifting the mindset from short-term pain to long-term gain.

Anchoring and Its Effects

Ever notice how the first price you see sticks in your head? That’s anchoring at work. Whether it’s the price of a car or a house, that first number can set the tone for everything else. To combat this, do your research. Check out multiple sources and prices before making a decision. This way, your choices are based on a broader view, not just the initial anchor. It’s like broadening your horizon before settling on a decision.

Recognizing and addressing these cognitive biases is key to making smart financial decisions. It takes self-awareness and a bit of courage to question our assumptions, but doing so can lead to more rational choices, free from the traps of our own minds.

The Significance of Long-Term Investing

Benefits of Compounding

Long-term investing is like planting a seed and watching it grow into a tree over the years. The magic happens with compounding. Compounding is where your money starts making money on its own. When you reinvest your earnings, you earn returns not just on your initial investment, but also on the returns accumulated over time. This snowball effect can lead to significant growth in your wealth, especially when you stick with it for the long haul.

Weathering Market Volatility

Markets go up and down, and it can be nerve-wracking to watch your investments fluctuate. But here’s the thing: by focusing on the long term, you can ride out the rough patches. When you invest with a long-term perspective, you give your investments time to recover from short-term dips. Instead of panicking and selling when prices drop, staying invested allows you to benefit when the market eventually rebounds.

Aligning Investments with Goals

Long-term investing isn’t just about making money—it’s about aligning your investments with your life goals. Whether you’re saving for retirement, a house, or your kids’ college fund, having a long-term plan helps you stay focused and disciplined. It encourages you to set clear objectives and choose investments that match your risk tolerance and time horizon.

Investing with a long-term mindset requires patience and discipline, but the potential rewards can be life-changing. It’s not just about the numbers; it’s about building a secure financial future that aligns with your dreams.

In the world of investing, your behavior plays a significant role. By understanding the importance of long-term investing, you can make decisions that not only benefit your financial health but also bring peace of mind. For those looking to reduce stress and anxiety related to money, understanding personal finance is a crucial step toward achieving financial stability and peace of mind.

Emotions and Their Effect on Financial Behavior

Managing Financial Anxiety

Money stress can hit hard. Whether it’s bills piling up or the fear of not having enough saved, anxiety can cloud your judgment. When you’re anxious, you might avoid looking at your bank account or delay making important financial decisions. It’s like that nagging feeling you get before opening a credit card statement. To tackle this, try setting small, achievable goals. Focus on what you can control, like making a simple budget or setting aside a tiny amount each week. Little steps can make big changes in calming your financial worries.

The Role of Optimism in Investing

Optimism can be a double-edged sword in the world of investing. On one hand, believing in a positive outcome can encourage you to take calculated risks, which is essential for growth. But watch out—overconfidence might lead you to ignore warning signs or underestimate risks. It’s like thinking every stock you pick will be the next big thing. Balance is key. Stay hopeful, but keep your eyes open and make informed decisions.

Emotional Triggers for Spending

Ever find yourself buying something just because you’ve had a rough day? That’s an emotional trigger at play. Retail therapy might feel good in the moment, but it can lead to financial regret. Recognize these triggers by keeping a spending journal. Write down what you buy and how you felt at the time. Over time, you’ll spot patterns and can work on finding healthier ways to cope, like going for a walk or calling a friend instead of hitting the mall.

Emotions can make or break your financial health. Understanding your emotional triggers and learning to manage them is crucial for making sound financial decisions.

Developing a Healthy Financial Mindset

Recognizing Negative Patterns

Before you can change your financial behavior, you need to spot the habits that are holding you back. Maybe it’s the daily coffee runs that add up, or the tendency to splurge on sales. Identifying these patterns is the first step towards change. You can’t fix what you don’t acknowledge.

Cultivating Positive Financial Habits

Once you’ve identified the negative patterns, it’s time to replace them with healthier habits. Start small. Instead of buying lunch every day, try bringing it from home a few times a week. Over time, these small changes can lead to significant savings. Consider implementing strategies like the 48-hour rule, where you wait 48 hours before making a non-essential purchase. This can help curb impulsive spending.

The Power of Financial Self-Awareness

Understanding your relationship with money is crucial. Are you spending to fill an emotional void? Or maybe you’re saving excessively out of fear. Self-awareness allows you to make financial decisions that align with your true goals and values.

“Becoming financially self-aware helps you align your spending with your values, leading to more satisfying financial decisions.”

- Set realistic financial goals that are specific, measurable, achievable, relevant, and time-bound (SMART).

- Create a budget that reflects your priorities and stick to it.

- Regularly review your financial situation to ensure you’re on track.

Developing a positive money mindset isn’t just about cutting back; it’s about understanding your motivations and making conscious choices that support your financial well-being. With time and effort, you can transform your financial habits and achieve greater financial stability.

Conclusion

So, when it comes down to it, personal finance is really all about how you act with your money. It’s not just about knowing what to do; it’s about actually doing it. You can read all the books and take all the courses, but if your behavior doesn’t change, your financial situation probably won’t either. It’s like knowing you should eat healthy but still reaching for that donut. The choices you make every day, whether it’s saving a little extra or resisting that impulse buy, add up over time. By being mindful of your habits and making small changes, you can set yourself up for a more secure financial future. Remember, it’s not about being perfect, but about making progress. So, start today by taking a good look at your financial behavior and see where you can make some tweaks. Your future self will thank you.

Frequently Asked Questions

Why is personal finance mostly about behavior?

Personal finance is mainly about behavior because how you choose to spend, save, and invest your money affects your financial health. It’s not just about knowing what to do; it’s about actually doing it.

How can my daily habits impact my money management?

Your daily habits, like spending on small things or saving regularly, add up over time. Good habits can help you save and grow your money, while bad ones can lead to debt.

Can my upbringing affect my financial choices?

Yes, the way you were raised can shape how you think about money. If your family taught you to save, you might be more careful with money, but if they spent a lot, you might do the same.

What is behavioral economics?

Behavioral economics studies how our emotions and thoughts affect our money decisions. It helps explain why we sometimes make choices that aren’t the best for our finances.

How can I improve my financial behavior?

You can improve by setting clear goals, making a budget, and sticking to it. Learning more about money and asking experts for help can also guide you in the right direction.

What are cognitive biases in finance?

Cognitive biases are mental shortcuts that can lead to mistakes in money decisions. For example, we might focus too much on losses instead of potential gains.

Why is long-term investing important?

Long-term investing is important because it allows your money to grow over time through compounding. It helps you handle market ups and downs and reach your financial goals.

How do emotions affect spending?

Emotions can lead to impulsive buying or risky investments. Feeling anxious might make you save too much, while being overly confident might lead to overspending.