5 expert-driven tips for paying off $50000 in credit card debt

Facing $50,000 in credit card debt can feel overwhelming, but it doesn’t have to control your life. With the right strategies, you can regain your financial freedom and pay off that debt faster than you think. This post shares five expert-driven tips to help you tackle your credit card debt effectively. From creating a budget to exploring debt consolidation options, these practical steps will guide you toward a brighter financial future.

1. Survey The Land

When you’re staring down a mountain of credit card debt, the first step is to survey the land. This means taking a good, hard look at your financial situation. It might feel overwhelming, but getting a clear picture is crucial.

Start by calculating exactly how much credit card debt you owe. List out each card, the balance, and the interest rate. This will help you understand where you stand and what you’re up against.

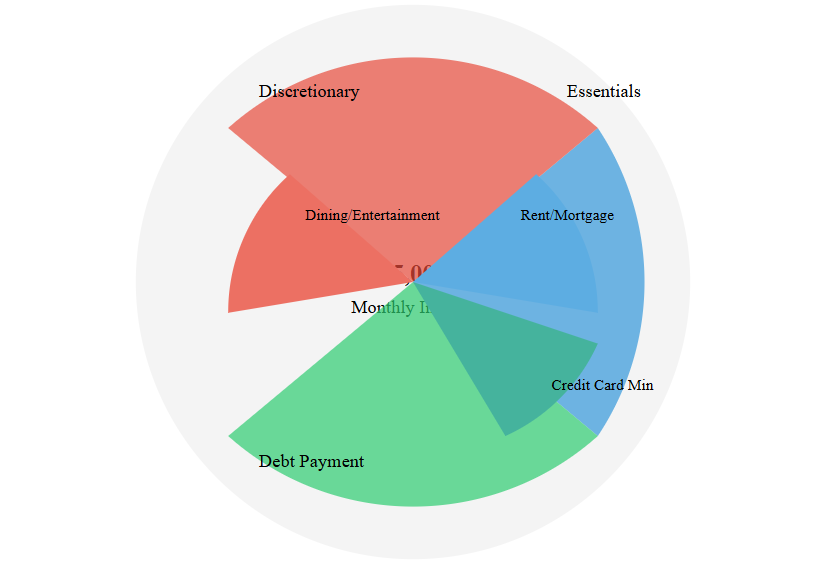

Next, assess your income. Knowing how much money you have coming in each month will help you determine how much you can realistically allocate toward paying off your debt. It’s important not to overestimate here; be honest with yourself.

Now, create a monthly budget. This is where you decide how much you can put towards your debt each month without sacrificing essentials. A budget helps keep your spending in check and ensures you have enough to cover your minimum payments and hopefully a little extra.

Taking the time to map out your financial landscape is like setting a compass for your journey out of debt. It gives you direction and a sense of control.

Consider using a simple table to track your debts:

| Credit Card | Balance | Interest Rate |

|---|---|---|

| Card A | $10,000 | 18% |

| Card B | $15,000 | 22% |

| Card C | $25,000 | 20% |

Breaking down your debt like this can make it feel more manageable and less like a giant, looming number.

Finally, keep a close eye on your progress. Regularly reviewing your budget and spending can help you stay on track and make adjustments as needed. Paying off debt is a marathon, not a sprint, so pace yourself and celebrate small victories along the way.

2. Limit And Leverage

When you’re staring at $50,000 in credit card debt, it’s time to get strategic. Step two in your debt-busting journey is to “Limit and Leverage” what you have. This means being smart about the resources and options available to you.

First, let’s talk about limiting. It’s crucial to stop the cycle of adding more debt. Avoid opening new credit cards just to chase those tempting sign-up bonuses. They might seem like a good deal, but they can lead to more spending. Instead, focus on reducing your current credit usage. Cut back on unnecessary expenses like streaming services or dining out frequently. This way, you can funnel more money toward paying off your debt.

Now, onto leveraging. Use the income you have more effectively. This might mean picking up a side gig or selling items you no longer need. Every extra dollar can help chip away at that mountain of debt. Consider using a debt consolidation loan if it offers a lower interest rate than your current cards. This can simplify your payments into one monthly bill, potentially saving you money in the long run.

Reflect on your spending habits and make conscious choices about where your money goes. It’s not just about cutting costs, but about making your money work smarter for you.

Here’s a simple plan to get started:

- Cancel any non-essential subscriptions or memberships.

- Allocate a set amount from each paycheck specifically for debt repayment.

- Regularly review your budget to identify additional savings opportunities.

By limiting unnecessary expenses and leveraging your current financial situation, you can make significant progress in reducing your credit card debt. Remember, it’s a marathon, not a sprint, but with perseverance and smart choices, you’ll get there. And whenever possible, consider paying your credit card bill in full to avoid those pesky interest charges. Keep at it, and soon you’ll see the light at the end of the tunnel.

3. Automate Your Minimum Payments

Managing credit card debt can be a real headache, but one way to ease the pain is by automating your minimum payments. Setting up automatic payments ensures that you never miss a due date, which is crucial for maintaining a good credit score. Missing payments can lead to late fees and even higher interest rates, which only add to your debt burden.

By automating, you simplify your financial life. You can set this up through your bank’s online bill pay service or directly with your credit card issuer. This way, the minimum amount due is automatically deducted from your linked bank account each month. It’s like putting your debt repayment on autopilot, giving you one less thing to worry about.

Here’s why automating your payments makes sense:

- Consistency: Never miss a payment, which helps protect your credit score.

- Convenience: Saves you time and effort by handling payments automatically.

- Peace of Mind: Reduces stress knowing your payments are handled on time.

Automating your minimum payments is a small step that can lead to big peace of mind. It ensures you stay on track with your debt repayment plan without having to think about it constantly.

While automating minimum payments is a great start, don’t forget to pay extra whenever possible. This helps reduce the overall debt faster. But at least with automated payments, you ensure you’re not falling behind. It’s a simple yet powerful tool in your debt-busting arsenal.

4. Pay Extra And Often

When you’re staring down a mountain of credit card debt, the idea of paying more than the minimum can feel daunting. But here’s a little secret: every extra dollar counts. The more frequently you chip away at your balance, the faster you’ll see it shrink.

Why pay extra? Well, the minimum payment often barely covers the interest, meaning your principal amount stays stubbornly high. By paying more, you’re directly attacking that principal, which reduces how much interest you accumulate over time.

How to Make Extra Payments Work for You

- Set a Monthly Goal: Decide on an extra amount you can afford to pay each month. Even if it’s just $20, it adds up.

- Use Windfalls Wisely: Got a tax refund or a bonus at work? Consider putting a chunk of it towards your debt.

- Round Up Payments: If your minimum payment is $47, round it up to $50 or even $60 if you can.

The Power of Consistency

Making extra payments isn’t just about the money—it’s about forming a habit. When you consistently pay more, even small amounts, you build momentum. You’re not just reducing debt; you’re changing your financial behavior.

“Debt reduction is not just about the numbers; it’s about building a mindset that favors financial freedom.”

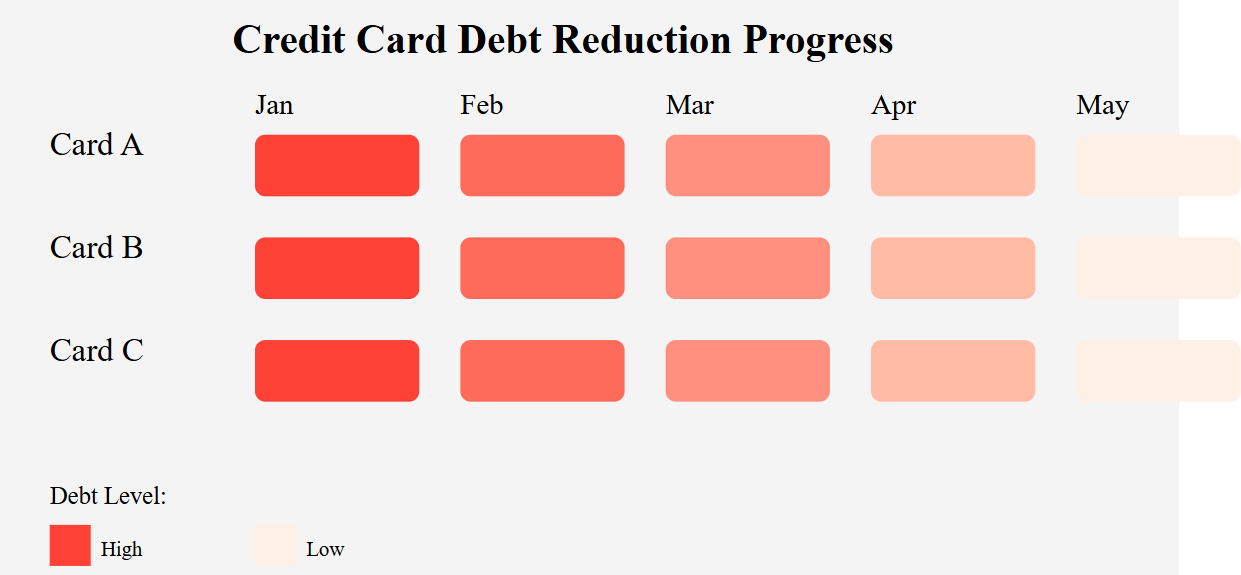

Keep Track of Your Progress

Create a simple table or chart to track your payments and watch your debt decrease. Seeing your progress can be incredibly motivating.

| Month | Extra Payment | Total Debt Reduced |

|---|---|---|

| Jan | $50 | $300 |

| Feb | $75 | $375 |

| Mar | $100 | $475 |

Remember, paying extra is a strategy that works best when paired with other effective strategies like budgeting and possibly considering a balance transfer credit card. Every little bit helps, and before you know it, you’ll be celebrating your debt-free status.

5. Evaluate The Plan Often

When you’re tackling a hefty $50,000 in credit card debt, it’s not just about setting a plan and forgetting it. Regularly evaluating your strategy is key to staying on track and making sure your efforts align with your financial goals. Here’s how you can keep your debt payoff plan in check:

- Check Your Progress: Every month, sit down and review your debt repayment progress. Are you on track with your goals? Are there any unexpected expenses that have thrown off your plan?

- Adjust When Necessary: Life happens. Maybe you got a raise, or perhaps an unforeseen expense popped up. Be ready to tweak your plan if your financial situation changes.

- Celebrate Small Wins: It’s important to acknowledge the milestones you hit along the way. Paid off a card? That’s a big deal! Celebrating these moments can keep you motivated.

- Reassess Your Budget: As you pay down debt, your budget may need adjustments. Maybe you can allocate more money toward debt repayment or start saving for a new goal.

- Stay Informed: Keep an eye on new tools or strategies that might help you pay off debt faster. For instance, some folks find success using balance transfer cards to lower interest rates temporarily.

“Evaluating your debt payoff plan regularly ensures you’re not just throwing money at the problem but strategically working towards financial freedom.”

By continually assessing your plan, you can make sure it still fits your lifestyle and adjust as needed. Remember, the journey to being debt-free is a marathon, not a sprint. Stay flexible and keep your eye on the prize.

Conclusion

Paying off $50,000 in credit card debt might seem like a mountain to climb, but with the right approach, it’s totally doable. Start by getting a clear picture of what you owe and make a solid plan. Cut back on unnecessary expenses and put every extra dollar toward your debt. Automate your payments so you never miss a due date, and don’t be afraid to adjust your plan as you go. Remember, every little bit helps, and staying consistent is key. With determination and these expert tips, you’ll be on your way to financial freedom. Keep at it, and soon enough, you’ll be debt-free and ready to start saving for the future.

Frequently Asked Questions

How can I start paying off $50,000 in credit card debt?

Begin by listing all your debts, including who you owe, how much, interest rates, and due dates. This will give you a clear picture of your financial situation.

What does it mean to leverage my income?

Leveraging your income means cutting unnecessary expenses to free up more money for debt payments. This can include canceling subscriptions or eating out less.

Why is it important to automate minimum payments?

Automating minimum payments ensures you never miss a payment, which helps maintain a good credit score and avoids late fees.

How can paying extra help reduce my debt faster?

Every extra dollar you pay goes directly towards reducing your debt, which can significantly cut down the time it takes to pay it off.

How often should I review my debt payoff plan?

Regularly check your progress to make sure your plan is working for you. Adjust as needed if your financial situation changes.

What is a balance transfer and how can it help?

A balance transfer involves moving debt from one card to another with a lower interest rate, helping you save on interest and pay off debt faster.

How long will it take to pay off my credit card debt?

The time it takes varies based on your payments and interest rates, but with consistent extra payments, many can pay off debt in 2-5 years.

Can paying off debt improve my credit score?

Yes, reducing your debt improves your credit utilization ratio, which can positively impact your credit score over time.